Introduction

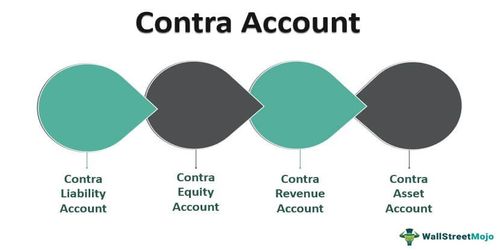

A contra account is an opposite entry that is used to balance the ledger's balances of related accounts. It helps the business determine the initial sum and the rate of value decline, providing the accounts' net balance.

What Does "Contra" Actually Mean?

What is a contra account? This is the first thing to think about. The definition of "contra" is closely related to the idea of trading or bartering. This suggests that a buyer and a supplier could be the same, trading goods and services of equal value. Accounts in the general ledger known as contra accounts have a balance that is different from the typical balance for the account type. A company can declare the initial amount using a contra account and then report a decrease to ensure the net amount is recorded. The common name for the net amount is the carrying amount or net realizable amount.

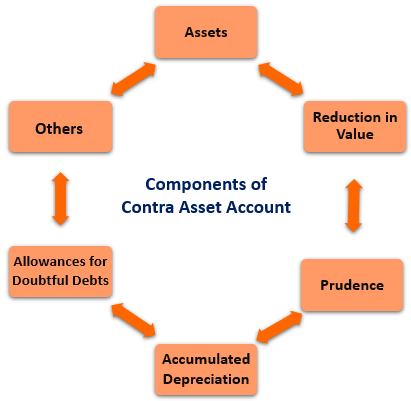

Counterparty Asset Account

Depreciation accumulated account is the most widely used substitute account. An account known as the fixed asset account balances this account. The initial purchase price of various fixed assets is kept in fixed asset accounts. The total depreciation costs incurred over time against the assets are included in the contra assets account (accumulated depreciation). The value of the remaining fixed asset is shown by the asset and contra asset accounts taken together. Contra asset accounts are not regarded as assets since they lack the long-term worth of assets, nor are they regarded as obligations because they do not have a future due date. Commitment.

Sales returns and allowances on the income statement are a counter revenue account connected to the sales account revenue. The business's net sales would be $397,700 if this account had a $3000 balance and a $400,000 projected credit in the Sales account. Instead of deducting revenues, this use of Allowances and Returns on Sales informs management that customers have a problem with $3,000 of the company's goods.

Illustrations of Contra Assets

Common contra assets include the following:

Account for Contra Liability

A liability is used to lower the liability's total by being recorded as a debit balance. A debit balance is the amount of a credit account in a liability account. The account lowers the liability's value. Contra Liability isn't as frequently used as other contra asset accounts. Because there is no chance that a future obligation would arise, it is not categorized as a liability.

Account for Contra Equity

The treasury stock account illustrates a contra-account in the context of equity. Since it represents the sum the corporation pays to the company to buy its stock, it qualifies as an equity deduction.

Account of Contra Revenue

Net revenue is the result of subtracting contra revenue from gross revenue. Transactions resulting in contra-revenue can be recorded in one or more contra-revenue accounts, which typically include the debit balance (as opposed to the credit balance of the usual income account). There are three well-known accounts for contra income. These consist of:

- Returns on sales. Includes a cushion to cover returned products or the precise amount of tax reduction attributable to the returned goods.

- Sales commissions. They could consist of a provision to lower the price of a product with minor defects or the precise sum of the provision that can be connected to specific sales.

- Sales promotions. This is the amount of the sales discount that is often given to consumers as an incentive for making early payments.

The Importance of Contra Accounts

It enables companies to monitor the general ledger's starting value and any value decline. It lets us see the asset's total depreciation and its particular historical worth. It helps in knowing the net balance by making it simple to access both the original sum and the actual reduction. It enables a business to display the net value by deducting it from the original value.

Why Should Contra Accounts Be Displayed on the Balance Sheet?

Users of financial statements might learn more about a company's assets by looking at how the contra asset account is reported on the balance sheet. For instance, if a company revealed the net value of its equipment, investors would not be able to understand the asset's cost, the amount of depreciation incurred, and the remaining useful life. Contra asset accounts give customers access to information on the amount of an asset written off, its remaining useful life, and its value. Now let's concentrate on the two counter assets that are most frequently used: accumulation depreciation and allowance for doubtful accounts.

Conclusion

One account is used in the general ledger as a contra account to lower the value of a linked account. They are helpful to demonstrate an increase or write-down on another contra account that adds to the current book value and safeguards the historical worth of the primary account. Contra accounts are listed in the same place on the financial statement as their associated accounts, typically just beneath them, with an additional row for the net. To keep the financial accounting books in order, it is necessary to highlight that accountants use Contra accounts rather than lowering the values of a primary account. Contra accounts are an excellent illustration of this. Include an allowance for accumulated depreciation and accounts with questionable balances.